- Your personal inflation rate may be different than the national or state inflation rate.

- Knowing your personal inflation rate can help you better plan both your short-term and long-term finances.

- There are always a few personal lifestyle adjustments you can make to combat inflation, bringing your personal rate down.

Inflation this, inflation that. Unfortunately, you can’t turn on a TV (or a smartphone) lately without being bombarded with financial doom and gloom. Another news report about gas prices, another social media post about housing costs. Inflation is hitting everyone pretty hard right now. It’s not, as the kids say, good vibes.

You could be seeing cost of living expenses rise anywhere from 8-to-13%, depending which report you read and exactly where you live. Certain specific items have gone up even more, like hotels (22% increase), airfare (37%), and gas (48%). However, inflation doesn’t impact everyone the same. For example, if you have a fixed mortgage, you don’t have to worry about rising rent costs. If you live in an urban center and take transit instead of owning a car, you won’t really be feeling the hike is gas prices.

So, what is your personal inflation rate? How do you calculate it? And why does it even matter?

What is a Personal Inflation Rate?

The national inflation rate is sitting around 10%. However, you may be impacted more (or less) than that. It all depends on your personal situation. For example, if you’re trying to buy groceries for a partner and three kids on a single income, your dollars are going to be tighter than someone who lives alone. If you have a long commute to work, you’re going to hitting the pumps way more often than someone who works from home.

So your personal inflation rate is basically exactly what it sounds like. A customized, individual measure of how inflation in affecting your own budget. It could be higher or lower than the national average.

Shutterstock

ShutterstockHow To Calculate Your Personal Inflation Rate

If you want to know exactly how inflation is wreaking havoc on your own budget, you’re in luck. Doug Kinsey of the Artifex Financial Group has created a “Personal Inflation Calculator.” It’s a spreadsheet that allows you to enter your regular bills and expenses. It then uses the Consumer Price Index to tell you how much you should expect those costs to rise.

“The worksheet I created takes some of the most common categories of household expenditures and allows us to enter annual amounts for those categories,” Kinsey explains. “The inflation factor for each item is then applied, resulting in an estimated price for that item or service in the current period. We then total all of those budget items up and develop a personal inflation rate from the difference.”

Shutterstock

ShutterstockWhy Your Personal Inflation Rate Matters

Inflation is definitely a scary and concerning thing. If you’re like most Americans, your wages are likely fairly stagnant right now. With everything else getting more expensive (except, apparently, your own labor), you’re going to find yourself in a tight spot, financially. However, inflation will definitely impact some people differently than others.

For example, if you use gas heat instead of electric heat, you’ll have a different inflation rate. If you are stuck in a variable rate mortgage, you’ll pay more as interest rates climb to combat inflation. Other variable rate debts, like credit cards or lines of credit, could also get more expensive if you’re carrying a balance.

Shutterstock

ShutterstockShort-Term Planning

Your personal inflation rate matters mostly due to short-term financial planning. We’re talking really basic things, like can you afford milk, bread, and eggs for your family this week. Or can you afford to put gas in the car that gets your kids to school and yourself to your job? Kinsey’s spreadsheet will help you understand exactly which items on your regular expense list are now more expensive than they used to be.

Knowing your personal inflation rate can help make sure your basic necessities are covered. If they aren’t, you’ll need to reexamine your overall spending habits or figure out how to bring in extra income. Or maybe both. On the other hand, if you’re in a comfortable enough spot that you’re not worried about how you’re going to pay the rent at the end of the month, we can shift to…

Shutterstock

ShutterstockLong-Term Planning

Inflation is a tricky beast. Some goods and services may see their prices drop back down a bit eventually. Others, however, may never go back down. That creates a “new normal” for financial expectations. If you were thinking about doing something major in the next year or two, you may need to reconsider.

When we talk about long-term planning, we mean larger lasting financial decisions. Buying a new car, applying for a mortgage to buy a house, or even planning a family vacation all fall under this umbrella. That new car you’ve been dreaming of? It’s more expensive, and interest rates are going up. Same with the “dream home” you’ve been saving for. And that long awaited family vacation? Hotel rooms and airfare costs have gone through the roof, so you better look at your trip budget again before firming up your travel plans.

Shutterstock

ShutterstockChanging Your Budget to Combat Personal Inflation

There’s not much you can do about national inflation rates. After all, you can’t alter gas prices, haggle with your utility companies, or change how much your local grocery store is charging for food staples. You can’t just skip paying your rent, mortgage, and other important things like health or car insurance.

However, we all still do plenty of discretionary spending. Take a long, hard look at your budget (you do have a detailed budget, right?). Try to pinpoint some areas where you can cut back, without severely lowering the quality of your life. Here are some suggestions:

Shutterstock

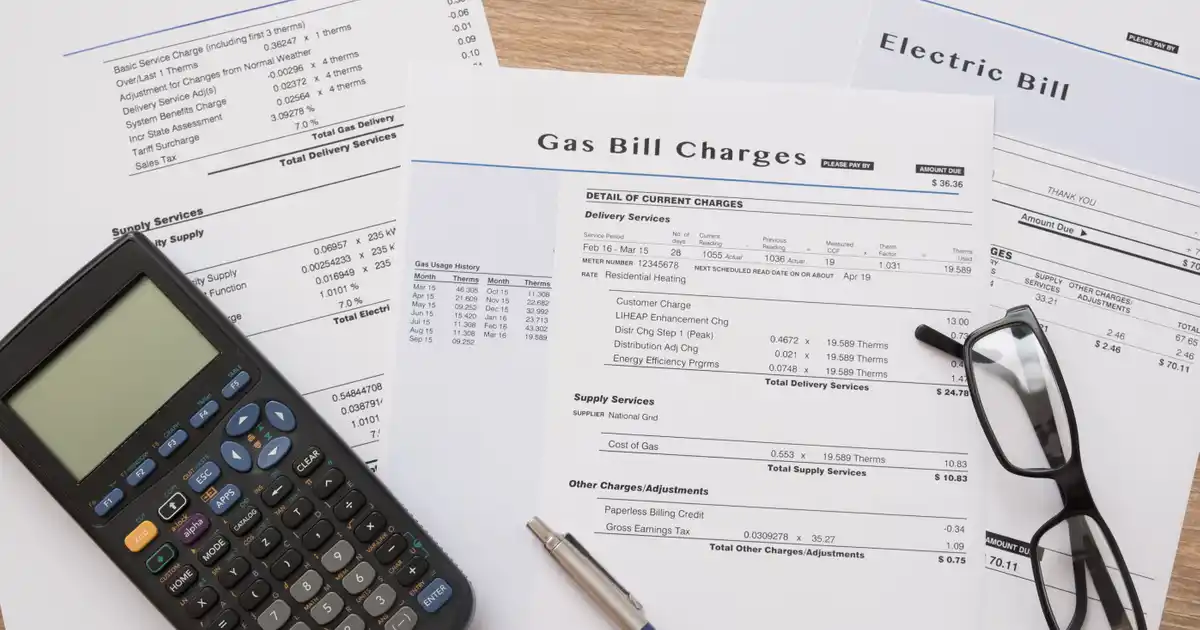

ShutterstockUtility Bills

We already said you can’t negotiate the price of electricity, natural gas, or water with the utility companies. You can, however, adjust your habits to use less of these things in your day-to-day life. Best of all, a lot of these adjustments are really simple.

For starters, make sure you’re cleaning or changing the filters and your air conditioning or furnace units. A clogged or dirty filter can make these appliances run up to 25% harder than they need to. Use a smart thermostat to make sure you’re not heating or cooling your home when no one is there. Run your dishwasher overnight, if possible, to pay a lower energy rate. Take shorter showers to use less water. The small things can add up, and help lower your personal inflation rate a bit.

Shutterstock

ShutterstockGroceries and Food

First, some good news! Some food prices are actually dropping again. Ground beef, apples, and pork products are all slowly declining, in terms of national average prices. On the other hand, plenty of things are still way more expensive than they used to be only a year or two ago. If you’re trying to trim your grocery bill, there are a few easy ways — they just require a bit of effort. For starters, cut coupons and meal plan ahead of time. Secondly, consider going to a cheaper store — there’s no law saying you have to keep shopping at Whole Foods.

In terms of dining out, it’s almost too simple for us to advise you to just “do it less.” Sure, maybe cut back a bit. But also look for local restaurants with deals, like half-price appetizers on Tuesdays or Kids Eat Free” promotions. Choosing to dine out on a Monday night will often score you better deals than a Friday or Saturday, which are the busiest nights at most places.

Shutterstock

ShutterstockTravel

With the rise of the internet, those with the travel bug have more options at their fingertips than ever before. You can comparison shop airfare, hotels, resorts, rental cars, event tickets, and pretty much anything else on the multitude of travel websites littering the world wide web. To further muddy the waters, companies like Airbnb and VRBO popped up to disrupt the traditional hotel model.

No matter where you want to travel, it can likely be done a bit cheaper with a bit of extra research. There are Airbnb competitors like Homestay or Hopper that are worth checking out. Consider flying a discount airline and save money by not checking a bag. Or maybe a local staycation is a better (and cheaper) option, as there’s probably plenty of great things to see and do that are only a short drive from where you live.

Shutterstock

ShutterstockStreaming Services

This one was a real eye-opener for me, personally. A quick audit of my household streaming and subscription services revealed the following monthly expenses between me and my partner: Netflix, DisneyPlus, Amazon Prime, Shudder (we like horror movies *shrug*), Spotify, Apple Music, extra iCloud storage, MLB At Bat Audio, Microsoft Game Pass Ultimate for Xbox and PC, and DAZN (I like soccer). It’s over $200 a month, and a lot of it we barely use.

Hopefully your house isn’t as streaming or subscription happy as mine was. Even still, these expenses can really add up. Heck, we don’t even bother with HBOMax, Hulu, or ESPN+. It could be even more money! In order to keep your personal inflation rate under control, consider picking and choosing your entertainment services wisely.

Shutterstock

ShutterstockThe Bottom Line

These double-digit inflation rates are definitely tough to swallow. Many Americans feel they are being squeezed from every angle, as companies and corporations do their best to shake every bit of loose change out of their pockets. While some of these new expenses are unavoidable, inflation doesn’t impact everyone the same.

If you like to pay close attention to your financial situation (and let’s be honest, you should), then do yourself a favor. Click the link above, download Kinsey’s Personal Inflation Calculator, and start filling it out. You may be shocked to find that inflation is hitting you even harder than you thought. Or you could end up relieved that your lifestyle has been resistant to some of the things that inflation has hit the hardest. Either way, having more knowledge about your money (and where it goes) is always a good thing.

Shutterstock

Shutterstock