When you think about a lease, it usually involves a vehicle. When buying a big ticket item like a car, most of us have to decide whether to buy the car outright (with financing) or pay to lease the vehicle. A lease typically runs for a set period of time (typically two, three, or five years). When the lease expires, you return the item.

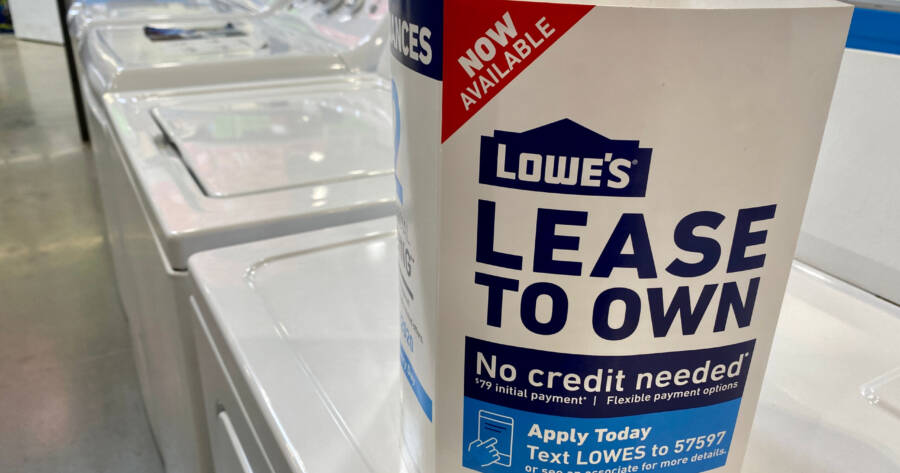

These days, you have the option to lease a wide range of big-ticket items. You can find lease (or lease-to-own) offers on everything from home appliances, furniture, big screen TVs, or snowblowers. Leases are no longer exclusively for vehicles.

Retailers (or financial companies they partner with) have discovered that there’s money to be made in leasing a wide range of products. If those leased products are returned, the merchants can turn around and lease them again to someone else. Or they can slap a “previously used” label on them and sell them at a discount. If you opt for a “lease to own” plan, you likely ended up paying extra fees in interest and convenience charges. So it’s win-win for the seller.

Either way, leasing is profitable for retailers. But does it really make sense for you to lease big ticket items? Here we breakdown some of the things to consider when deciding if you should lease your next major purchase.

Understanding A Lease

Let’s start with some basic information about a lease. When you buy a product outright, you pay upfront for the total cost of the item. You might finance it (on behalf of yourself) with a credit card or line of credit. You might know, for example, that you can have the large expense paid off in a matter of six months. You’ll pay your credit card company some interest for the trouble.

However, the benefit of buying an item outright is immediate ownership. With a lease, you essentially pay to rent the product for a set period. You make small monthly payments instead of one large payment. When the lease period ends, you return the item. Or if you’re leasing-to-own, you own the item fully — but only after 36 months of payments.

Leasing expensive items can be attractive to those who are strapped for cash or without much credit. After all, you need a fridge in your kitchen. But if you can’t afford $1,500 for a new one, you can lease one for $40 a month. In the short term, it solves your problem. You can scrape together the monthly payment and keep your food from going bad. However, when you do the math, you might be shocked. Those $40 a month payments, over five years, come out to a grand total of $2,400. That’s $900 more than the regular price.

Need vs. Want

This is a debate that has been raging since currencies and banks were first invented. Is the big-ticket item you’re thinking of leasing a need or a want? There is, after all, a difference between needing a new refrigerator because your old died and wanting a new couch because you’re sick of the color of your current one. Distinguishing between needs and wants will help you to make smart purchase decisions.

If an emergency occurs, then it may make sense for you to run out and lease a refrigerator. Yes, it will cost you more in the long run, but it solves your immediate need at a monthly cost you can afford. However, if the only thing wrong with your couch set is that it looks a bit dated, then paying to lease more modern furniture is unwise. That’s the kind of expense you gradually save up for and buy outright. Until then, tolerate the old couch.

Purpose Of A Lease

Along with distinguishing between wants and needs, it’s also important to consider the purpose of an item you’re considering leasing. For example, is the big-ticket item you’re considering leasing something that you’ll need long-term? Will you use it every week, like a washing machine and dryer set? Or is it something you’ll only need occasionally, like a chainsaw or snowblower?

Also consider whether there are alternatives to leasing. For example, do you need a snowblower when a shovel will do? Do you need to lease an expensive ride-on lawnmower when you could buy a less expensive push mower instead? Do you know anyone that you could borrow a chainsaw or table saw from? Many places will rent you tools for a weekend, at a much lower price. Why pay hefty leasing fees for something you only need to use two or three days a year?

As a rule, it really only makes sense to lease essential household items that you cannot live without. If you need it on a regular basis, like a refrigerator, furnace, or hot water tank, then, well, you need it. If you can’t afford it with stashes away savings, a finance plan, or available credit, then leasing may be your only option. So be it. However, before entering a lease you need to give some thought to any alternatives that may be more favorable to you financially.

Fees and Interest

Although leases tend to offer cheaper monthly payments than financing, the reality is that leases are not cheap. They often come with high interest rates and lengthy terms that will cost you in the long run. Some retail store lease programs are even more costly than using a credit card. We’re talking north of 20% APR. Not only that, but they often come with convoluted fee structures designed to make you pay more.

There are extra charges, for example, if the bi g-ticket item you lease comes back nicked or damaged. Or if you try to break the lease early. As previously mentioned, a lease-to-own plan may seem great at first.

“Oh wow, I can get this new laptop for just $29 a month!”

Do the math, though, and you’ll realize that the final amount of money you’re handing over is much more than the retail price. Most of these lease programs are simply preying on those with no credit or no savings. Remember, retailers see leasing as a win-win for themselves. They collect monthly payments from you for years. After that, they either get the product back or have collected much more than it was originally worth.

Contracts and Fine Print

As mentioned, lease agreements can be convoluted. There is usually a lot of fine print to comb through. Before you sign on the bottom line, be sure to take the time to fully understand how the lease works. Be sure you know the various fees and penalties that can be levied against you should you miss a payment, damage the item, or try to end the lease early.

Be aware that the lease agreement is designed to ensure the retailer gets their payments and that the big-ticket item is protected as much as possible. It wouldn’t be a bad idea to have a lease agreement you’re considering reviewed by a lawyer. If you can afford one, that is. And if you’re thinking about leasing a 60″ TV or a yard tractor, you probably can’t.

They say that the devil is in the details. This is certainly true of lease agreements. Whether a lease is for a car or just a hot water tank, there’s a reason the written agreement is so long.

The Bottom Line

From a financial standpoint, leasing big-ticket household items only makes sense in an emergency. If the item is essential to your daily life and you have no other way to pay for it, well… do what you have to do. Paying cash and avoiding interest charges is always the best way to buy expensive products. After that, getting the best interest rate you can should be your goal. Maybe it’s using a personal credit card at 18% or a personal line of credit at 7%. However, a high interest lease agreement should be your last resort.

Shutterstock

Shutterstock