Taxes

Taxes

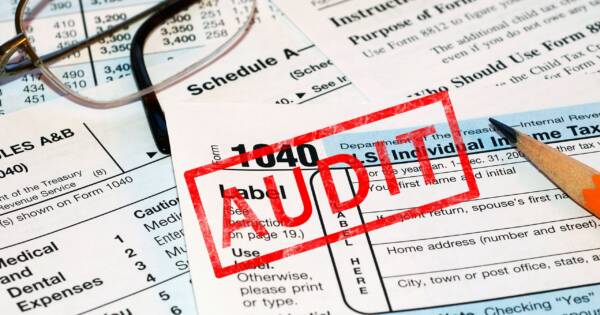

How to Avoid a Tax Audit

Getting audited is something everyone wants to avoid. Even if you’ve been careful and honest in filing your taxes, mistakes do happen. Having the IRS go over everything with a fine-toothed comb is bound to be a stressful experience. Over the past few years, the number of IRS audits has trended down. This was largely […]

5 minute read