You may have seen the term APR while applying for a new credit card. It officially stands for Annual Percentage Rate. Whether you are a first-time credit card user or a long-time card holder, the term APR is one you need to understand. The term APR is often interchangeable with annual interest rates (AIR), though it does depend on the credit product. For credit cards, APR and AIR are generally the same cost.

Knowing what an APR is, how it is calculated, and how it’s applied can you help you make informed credit decisions.

What is an APR?

The definition of APR is a simple one. It is the cost of the money you are borrowing. Most credit card companies will list this rate annually. So, to find your monthly interest cost, simply take the APR and divide by 12. If you have an APR of 18%, for example, divide that by 12 and find your monthly fee is 1.5% on the purchases you do not pay in full on your billing cycle.

When using your credit card, you can avoid paying interest by paying your bill in full every billing cycle. Carrying a balance past the due date by only paying your minimum monthly payment is one of the most common ways you will see an APR charge on your next bill.

More Examples

Say you purchase an item for $400. You still have that 18% APR and only make the minimum payment of $16 a month. It would take you almost three years (34 months) to pay off this balance. In the end, it costs you an extra $114 in interest.

These interest charges can be avoided by paying off your bill within the credit card grace period. Most credit card companies offer a minimum grace period of at least 21 days from the close of your billing period. This grace period ends when payment is due.

Types of APRs

There are different types of APR, depending on exactly what they are for and how they are applied. Here are the most common ones you’ll encounter.

Purchase APR

This is simply the rate charged on new purchases. Every regular purchase you make with your credit card will be subject to this APR unless you pay off your balance by the end of the billing cycle.

Balance Transfer APR

This is the APR that is applied to any balances transferred to your credit card. These can vary wildly. Sometimes they can be higher than your purchase APR. However, if you have good credit, banks will often advertise a lower APR for balance transfers in order to get your debt transferred to them. Read more about the pros and cons of balance transfers right here.

Introductory APR

Most credit card companies will offer an initial promotional rate to customers opening new accounts. It typically lasts for somewhere between six and 24 months. Some companies will offer this rate on both purchases and balance transfers. These promotional rates are usually an extremely low interest period — sometimes as low as 0%. Yes, no interest at all! These offers can be an excellent opportunity to save on interest charges and even get out of debt.

Cash Advance APR

This is the APR that you incur if you take cash out from your credit card. A cash advance rate is usually the highest on your card. It also normally does not have a grace period. You will be charged interest immediately after taking the cash out. As a general rule, it’s never a great idea to use your credit card for cash advances. It’s just too costly.

Penalty APR

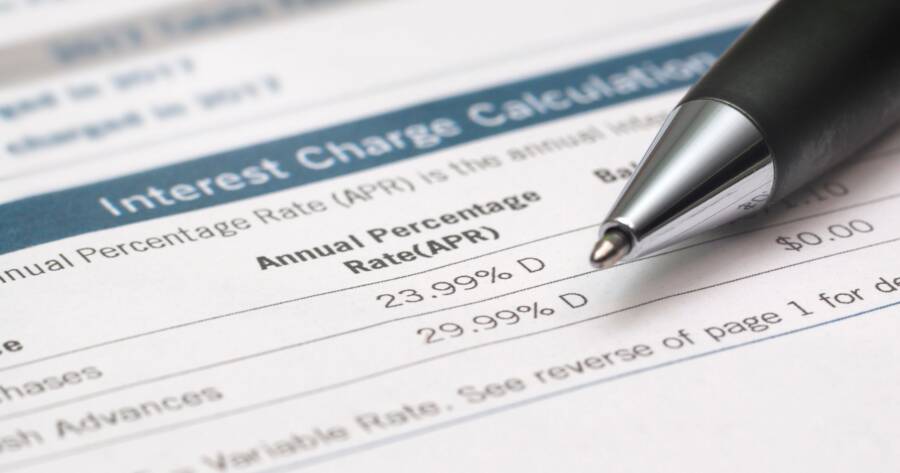

Paying your bills late is never a good idea, especially when it comes at such a high cost. Most credit card companies will charge up to a 29.99% penalty when your bill is not paid on time. This does not include only paying your minimum balance, which is deemed an acceptable amount. Still a bad idea, though!

What Affects your APR?

The APR you receive often varies with the prime rate. The “prime rate” is the best interest rate companies will issue to their customers. There are two types of APRs that you can receive: fixed and variable.

With a variable APR, when the prime rate decreases, your APR typically decreases too. If the prime rate increases, so does your APR. Variable APRs also fluctuate based on your credit score. Cardholders with excellent credit scores (780-to-900) will receive an APR close to the lower range. Those with average to good credit (679-to-779) will get a mid-range APR. If you are below the 650 mark, you’ll likely pay a higher APR.

However, if you open a card with a fixed APR, you’ll receive the same rate regardless of your credit score or the fluctuation of the prime rate. The issuer may still change the interest rate, but usually only after a written notice is sent.

How to Find Your Credit Card’s APR?

Your APR will be located on every monthly statement you receive. It’s typically listed in the section about how your interest charges are calculated. You can also often view your APR when logging into your online account or your mobile banking app. If you are having a hard time finding the number on your statement, you can always call your credit card’s customer service number and ask a service representative.

How to Avoid APR Charges

The best way to avoid falling into credit card debt is to prevent APR charges. Here are two ways to avoid interest charges.

Pay Your Balance in Full Every Month

We already mentioned it, but this really is the simplest way to avoid interest charges. Setting up autopay, so your balance is automatically paid every month, is a smart way to make sure the balance is paid. Make sure to still check your statement for errors. You’ll also need to ensure the money is readily available for your payment date.

Open an Intro 0% APR Card

These introductory rate cards can offer up to 18 months of no interest on new purchases or up to 24 months of no interest on balance transfers. Just be sure to pay off your balance before the intro period ends. If you don’t, you could find interest applied to the entire balance, which then saves you nothing at all.

If you find that you are still carrying a balance into each new billing cycle, consider opening a new low-interest credit card and transferring the balance. There are many to choose from, and they can help you save money.