Understanding stock market terminology is essential for anyone beginning to navigate the world of investing. From basic concepts to more specialized market signals, each definition helps clarify how shares function, how investors evaluate opportunities, and which factors drive price movement. Building familiarity with common terms allows new investors to interpret market behavior with greater accuracy, make informed decisions, and approach financial planning with confidence. A strong vocabulary foundation creates more clarity and reduces uncertainty along the investing journey.

A for Active Share

This can more easily be termed as a share that is sold three or more times a week. This type of share is easily bought and sold. An active share has frequent day-to-day dealings.

B for Booking Profit

This is when you make a profit from a share that has gone up above its purchasing price.

C for Cum Dividend (CD)

Until the share has been declared XD or no dividend, the buyer of this share is eligible to receive the dividend for the entire year before it was bought.

D for Depository Receipt (DR)

This is a tradable item that is valued in the same amount as a fixed number of shares, which typically goes on in overseas markets.

There are two different markets DR can be associated with. They are:

- American Depository Receipt (ADR), and;

- Global Depository Receipt (GDR).

This is known to be done mainly with the Indian overseas market.

E for Eligible Securities Shares

Banks will more than likely make their own rules when it comes to these shares, debentures, and bonds. These are usually shares that are used as collateral when it comes to bank loans.

F for Floating Stock

This is the number of shares of a company that is traded on the stock exchange. It usually has a fraction of the total number issued and outstanding.

G for Golden Share

This kind of share is a share that controls 51 percent or more of the voting rights of a company.

H for Hemline Theory

The theory that stock market prices go up as the hemlines of women’s dresses go up.

I for Investment Letter

When shares are privately placed, there is a written agreement between seller and buyer that stipulates that the shares are bought for investment purposes only. They cannot be resold publicly for short-term gains.

J for Joint Holders Shares

Although all notices and dividends will be sent to the first holder only, a share can be held jointly by two or more different people at once. When it comes time to sell this share, all three people would have to be present to sign the documents, not just the first holder. If the first holder passes away, the second holder will automatically become the beneficiary.

K for Kicker

This is an incentive to a buyer of a debt instrument that will come in the form of an attached equity warrant. This could also be called a sweetener.

L for Liquidation

A liquidation is considered to be a winding up of a company. This is usually done through a resolution passed by shareholders or bankruptcy once the purpose has been fulfilled.

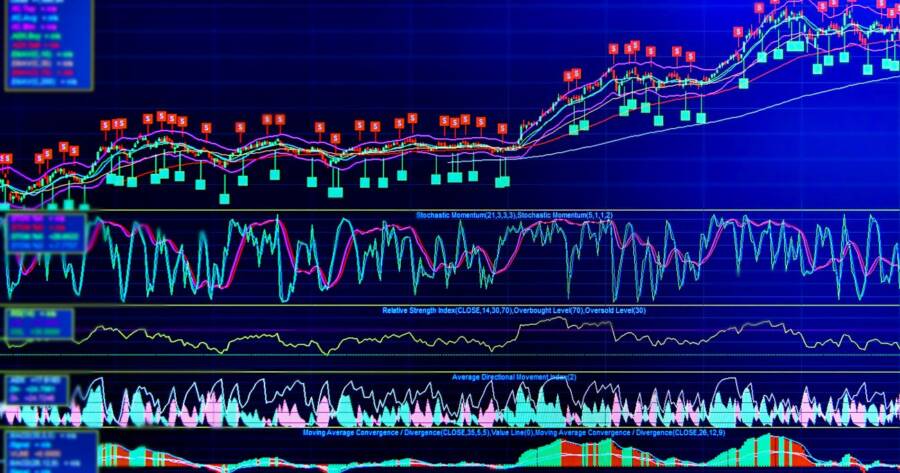

M for Moving Average

This is the average for share prices during a specific period of time, whether it be a week, month, or year. This is done instead of posting daily fluctuations in the stock price.

N for Nervous Market Stock

This is referred to as reacting quickly to different economic or political events throughout our country, such as annual budgets unfavorable to industrial growth or price controls.

O for Option Interest

This is considered to be a bit different from exact interest. Exact interest runs 365 days per year, while option interest runs 360 days a year. There can be a big difference in money when it comes in large amounts.

P for Put Call Ratios

This is said to be a ratio of the trading volume of put options to call options.

Q for Quantitative Analysis

This analysis is dependent solely on financial information and deals with financial securities.

R for Rule of 72

This is a well-known formula for calculating the number of years an investment will take at a compound rate of interest to double.

S for Stochastic Oscillator

It is a momentum indicator that compares a security’s most recent closing price to its high–low range over a set period, helping traders gauge whether market conditions are overbought, oversold, or signaling a potential trend reversal.

T for Turnaround

This is when a company makes decisions that are better for their company overall and its financial status.

U for Unsecured Debt

A loan that is not supported by any mortgage or repayment.

V for Volatile Shares

These are shares that are subject to high fluctuations in prices.

W for Wallflower Stocks

These are shares that are neglected by analysts and stockholders.

Y for Yield to Maturity

This is the calculation of the rate of return to any investor in the long run.

Z for Z Shares

These are the mutual fund shares of a class available to employees of the fund.

A Broader Perspective for New Investors

Learning foundational stock market terms provides a strong starting point, but true confidence comes from continual learning and real-world experience. Each concept—from share activity to market behavior—helps shape smarter decisions over time. Whether the goal is long-term investing or short-term trading, building knowledge gradually fosters better judgment and reduces unnecessary risk. Approaching the stock market with patience and curiosity allows investors to develop skills that support financial growth and more strategic participation in an ever-changing market.