- Inflation refers to the gradually rising costs of goods and services.

- Inflation effectively reduces the buying power of your dollars.

- The impact of inflation can be somewhat combated by investing in the real estate and stock markets, or finding ways to earn more money.

You’ve probably heard the word “inflation” thrown around a lot lately in the news. The unprecedented economic upheaval caused by the pandemic created massive ripple effects. Although inflation can be a complex financial topic, it really boils down to one simple fact for most average Americans: things are getting more expensive.

Prior to the pandemic, inflation was rarely in the news. However, it was still happening — just much less dramatically. In the years of 2019 and 2020, inflation was between about 1.5% and 2%. So it always existed, but wasn’t as noticeable. These days, consumers are looking in inflation rates between 7% and 12% (depending on where you live and your source). As a result, the impact it’s having on our budgets it much more obvious.

What is Inflation?

The basic definition of inflation is the decline of purchasing power that a certain currency has over time. Different currencies can see different levels of inflation, based on how their backing government acts. (That’s why Zimbabae had trillion dollar bills.) It’s pretty much common sense that things slowly increase in value over time. However, that increase can actually be measured, which is where we get the term inflation.

Inflation is generally determined by finding the average price of a “basket of goods” and select services, then comparing them to a time in the past. It’s typically the same month, a year prior. The end result for most people is the things they regularly buy get more expensive. In most cases, incomes don’t rise accordingly. And if they do, it’s almost never as fast as inflation itself.

Shutterstock

ShutterstockWhat Causes Inflation?

There are a few different causes for inflation. The simplest is that the raw materials of a product get more expensive. That means the company selling the product to you needs to charge more in order to at least break even or turn a profit. The simplest example is something like wheat. If the cost of wheat rises, then so does the cost of bread at the grocery store.

Inflation can also happen when production costs (as opposed to raw material costs) go up. For example, let’s say the meat and dairy industry is suddenly subject to new government safety tests and standards. Implementing those safety protocols will cost meat and dairy farmers money, which will in-turn raise price of their goods.

Another common cause of inflation is a surplus of currency. If a government infuses a bunch of extra cash into the economy by simply printing more of it, it lessens the value of every single dollar every so slightly. This recently happened when the pandemic hit. The government offered stimulus checks to millions of Americans who suffered income loss due to the pandemic. However, that influx of cash also contributed to inflation.

Shutterstock

ShutterstockHousing Costs

While rising housing costs are sometimes caused by greedy landlords, who keep raising the price of their rentals every single year to extract maximum value, they aren’t always to blame. Plenty of mortgages use a variable interest rate. That means the owner’s mortgage payment rises if interest rates also rise. And rising interest rates is one of the ways that federal governments combat inflation.

When interest rates go up, mortgage payments go up for some (but not all) home owners. If the owner is renting that space out, they may need to increase the rent accordingly. This is usually a short term increase, though. The rising interest rates make it more expensive to borrow money, which means fewer people will apply for mortgages to buy new homes. With fewer buyers, the average home price can actually drop after a while.

Shutterstock

ShutterstockGas Costs

One of the biggest impacts of inflation is higher gas prices. A lot goes into producing and transporting gas to your local gas station. From the time the oil is pumped out of the ground, refined into gas, and shipped to your location, a lot of money is spent. When those costs rise, the oil and gas companies raise their own prices to maintain their profit margin.

There’s also the very real impact of Russia’s military conflict with Ukraine, which has seen the country sanctioned by many other nations. The lack of Russian oil on the market decreases the overall supply, increasing the price.

Of course, these companies continue to report record profits on a regular basis. So there’s a very fair argument that the insanely high gas prices we are seeing in mid-2022 are a combination of both inflation and corporate greed.

Shutterstock

ShutterstockGrocery Prices

If you’re a part of the American middle class, you’ve certainly noticed those grocery store trips are stinging the wallet more than they used to. Meat and dairy are two supermarket items hit hardest by inflation, but basically everything is a bit more expensive than it used to be. Even staples like bread or pasta have gone up in price.

In some cases, the price of groceries have historically dropped again after periods of high inflation. However, we certainly don’t expect things will return to their pre-pandemic prices anytime soon — and probably not at all.

Shutterstock

ShutterstockHigher Interest Rates

To help keep higher prices in check, governments typically respond to high inflation by raising interest rates. That makes it more expensive to borrow money. That tempers things like luxury purchases (a new car or boat), small business startups, or college graduation rates. In turn, this causes citizens and corporations to tighten their belts a bit, spending and investing less.

The result is less cash being splashed around. As the cash becomes more scarce, it increases in value. This increase in value can help fight (but rarely erases) inflation. The opposite of inflation is deflation, and that can be just as damaging for an economy. If the buying power of a dollar gets too strong, the feds will drop interest rates again. They generally aim to keep it around 2%, whenever possible.

Shutterstock

ShutterstockUtility Costs

Utilities are another thing heavily impacted by inflation. According to CNBC, those who heat their home with natural gas will spend roughly 30% more than normal. Those who electric heat will also see an increase of at least 6%. While propane and oil heating, although not as common, will also see steep increases of 54% and 43%, respectively.

It’s not just heat. The cost to run your air conditioner (and even just your regular appliances and electronics) is also going up. Energy prices are, on average, were up over 33.3% by the end of 2021.

Shutterstock

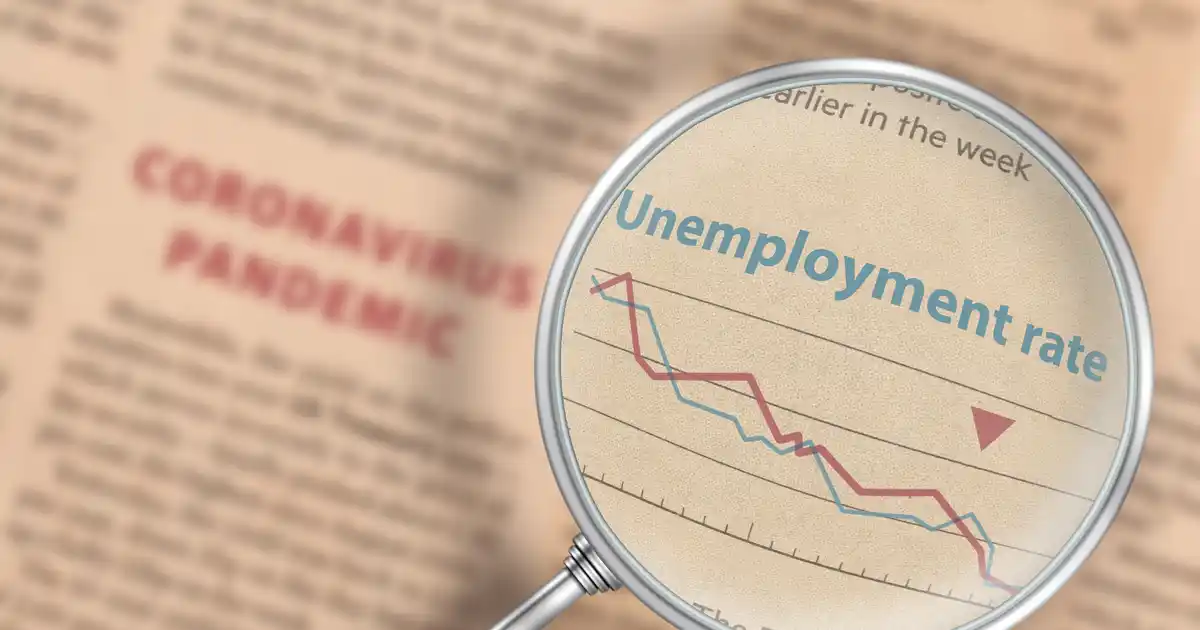

ShutterstockReduced Unemployment

Inflation and unemployment usually (but not always) trend in opposite directions. That means when inflation goes up, unemployment goes down. You may have seen multiple articles lately about some businesses struggling to find workers. It’s not because workers are lazy, though. It’s a result of workers demanding to be paid their worth in an increasingly expensive economy.

In simple terms, labor is currently in low supply and high demand. That means companies who are willing to offer more competitive compensation packages are able to hire new employees. That, in turn, increases the cost of running their businesses. Usually, those costs are passed down to consumers in the form of higher prices. And the cycle continues.

Shutterstock

ShutterstockReduced Buying Power

The term “reduced buying power” is right there in the definition of inflation. It means the same amount of money doesn’t go as far as it used to — something many Americans are learning the hard way right now.

For example, let’s say you bring in $3,500 a month, after taxes. With some careful budgeting, that used to cover your rent, car payment, groceries, and other important bills, with enough left over to stash some into savings or splurge on something fun. This year, that same $3,500 might not even care the bare essentials. Suddenly, you’re left trying to figure out how to either make more money or start cutting expenses.

Shutterstock

ShutterstockStagnant Wages

One of the biggest issues with inflation is stagnant wages. Some economists go as far as to suggest that if you don’t get an annual wage increase that, at the least, keeps up with inflation, you’re effectively getting a pay decrease. Although you’re not technically making less money than you were before, the staples and necessities of life all cost more. That leaves you with less discretionary income (or none at all).

If your employer has a policy of only giving out 1%-to-3% annual increases, or only offer raises for merit-based seasons, your wages might not be keeping up with inflation this year. Younger generations are catching on, though, and are switching jobs much more frequently.

Unfortunately, you’re much more likely to get a decent raise by switching jobs than by sticking around your current one. The companies who realize this and provide the right incentives to keep their current employees happy tend to be better places to work.

Shutterstock

ShutterstockHow To Combat Inflation

Unfortunately, there’s not much you can do to change the price of things you need. In terms of your monthly budget, all you can really do is either try to cut costs somewhere or find a way to earn some extra money. However, there are a couple of more long-term solutions that can help protect your finances against inflation.

The first step is to invest in the stock market. Over a long enough period, the stock market typically averages a 6%-to-10% return annually. That will beat inflation rates in most years. If you just leave your savings in a high-yield savings account, it might return 3% or 4% a year — if you’re lucky. In high inflation years, it can be argued that you actually lost money.

The next way to combat inflation is to buy a home. We know, it’s easier said than done, especially these days. However, investing in real estate has long proven to be a reliable way to grow your wealth. Whether you plan to buy a home to live in it, or just to rent it out, its value will increase over time. Yes, even after periods of market correction, where housing prices stall (or even drop) for a while.

The best way to combat inflation is to invest in yourself. If you think your current career prospects and income potential have peaked, then start planning for what’s next. Things are only going to keep getting more expensive over the years, so you need to adjust accordingly. Learn some new skills, make a career switch, further your education, or have a frank talk with your employer about what you need to do in order to earn more money.

Shutterstock

ShutterstockThe Bottom Line

Inflation isn’t going away. Even if we assume the government can get things under control going forward, you’re still looking at an average of 2% inflation every year afterwards. It’s a fact of life, so you might as well start planning for it. The 2021 and 2022 years have been especially hard, with inflations rates higher than most of us have seen in our lifetimes.

Start thinking about your investment and saving strategies. Start focusing on your long-term career goals. You can’t afford to stand still, financially speaking, while inflation continues to rush past you.

Shutterstock

Shutterstock