Computers, smartphones, and internet technologies continue to advance as a blistering pace. It should come as no surprise that the finance industry is being heavily impacted by these advancements. The days of taking your paper paycheck to your local bank branch in order to deposit it into your account are over. Heck, it’s even rare to see someone paying with cash these days. It’s almost like a relic of a forgotten time whenever someone pulls out a wad of bills to complete a transaction.

New online finance companies are popping up everywhere. They’ve even spawned a new industry term — “Fintech.” That’s short for financial technology, in case you were wondering. These fintech companies are trying to revolutionize banking by making it easier, more affordable, and more accessible to everyone. From simple checking accounts to investing or mortgages, you don’t have to rely on the traditional big banks anymore. You have options!

Here are ten new fintech companies that are trying to disrupt the old banking industry with cutting edge software and ideas. And we promise that they aren’t all related to Bitcoin or cryptocurrencies. Honest.

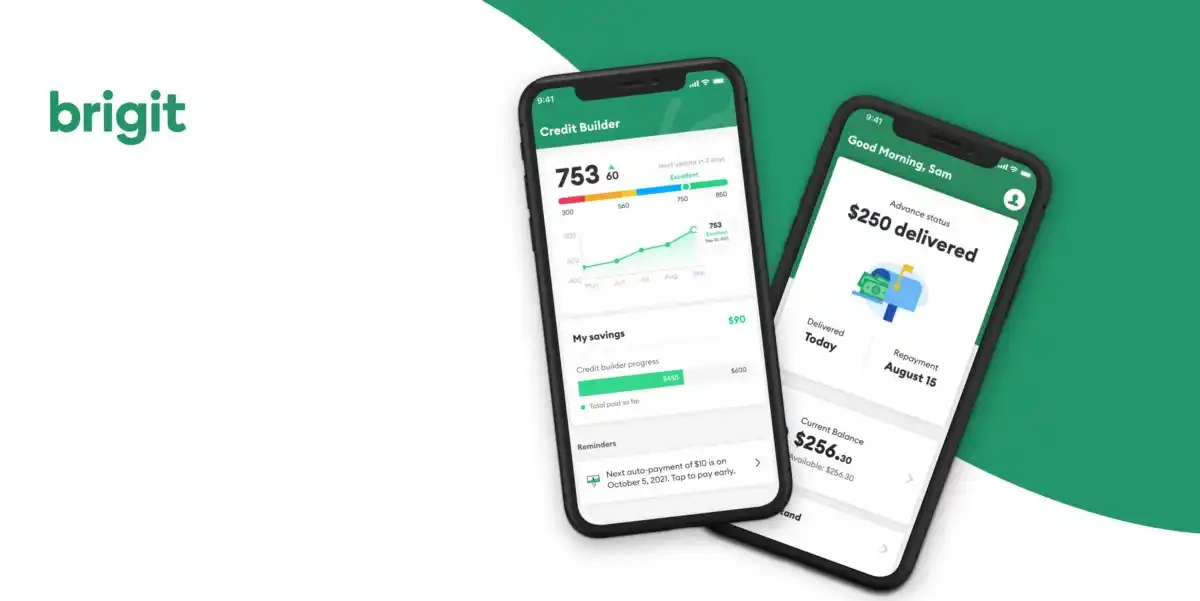

Brigit

Estimated Valuation: $600 million

Brigit is a financial app, but with a twist. It’s goal is to teach Americans financial literacy skills, but also acts as a way to increase your credit score and avoid expensive overdraft fees. The app, which has both a free and a paid subscription version, links to a user’s bank account. Based on their cash flow habits, an algorithm automatically extends them an interest free loan of up to $250. The loan can also be used to prevent overdraft situations.

The loan comes with predetermined terms, for quick paybacks. The good news is that these small loans (and their repayments) get reported to the major credit bureaus. Using Brigit can raise your credit score up to 60 points, according to the company itself. The only downside is that you’ll have to pay $9.99 a month to have access to these loans or overdraft protection. The free version only offers financial advice.

Source: Brigit

Source: BrigitChipper Cash

Estimated Valuation: $2.2 billion

The ease of making financial transactions in the United States is almost taken for granted. In many other parts of the world, though, it can be difficult to send and receive money. Chipper Cash aims to bridge that gap. Founded by Ham Serunjogi and Maijid Moujaled, from Uganda and Ghana, respectively, the app cuts through some of the cross-border red tape.

Chipper allows users from the U.S., U.K., and five African countries (so far) to pay bills and make cross-border transactions. They also have the ability to buy, transfer, and sell Bitcoin. For those trying to send money back to their families in Africa, converting to crypto first has actually become a useful tactic to avoid their money being lost to corruption or high fees. Chipper earns their revenue through foreign exchange fees and crypto brokerage commissions.

Shutterstock

ShutterstockClearco

Estimated Valuation: $2 billion

Clearco isn’t targeting run of the mill consumer banking customers. This Canadian-founded platform aims to revolutionize the investment and funding of startups. Clearco focuses on providing funds to e-commerce startups. To date, they have distributed more than $3.2 billion in funding to more than 7,000 different startups. The investments typically range from $10,000 to $2 million.

The company uses “blind funding” algorithms to generate fast term sheets and linked software to track key performance metrics of the companies they invest in. By being “blind”, Clearco claims they the companies they fund are nine times more racially diverse and 25 times more likely to have female founders than a typical venture capital company.

Shutterstock

ShutterstockColumn

Estimated Value: N/A

Before we talk about column, we have to back up slightly. You know all those new-age, digital, online-only banks that you see advertised to young people? Well, they aren’t really banks. Not in the traditional sense, anyway. They are just software platforms, who need to partner with actual certified banks behind the scenes in order to make their businesses work.

Column wants to be that bank. They are a federally chartered bank, aiming to replace the “patchwork” of other financial institutions that back all these new fintech online bank apps. Column has a single national branch location, located in Chico, California. It already has $300 million in deposits, and growing all the time.

Source: Column

Source: ColumnCreative Juice

Estimated Value: $75 to $100 million

Creative Juice is a special financial startup with an extremely niche target market. In short, they exist solely to benefit online creators. Yes, we’re talking YouTube stars, famous Twitch streamers, or major TikTok personalities. Their digital banking app is a perfect fit for those who earn their living by putting content out into the online ether.

If you’re an up-and-coming online star, Creative Juice is still for you. They offer investment dollars to help you grow your audience, from $25,000 up to $500,000 investments. In exchange, you have to give up a percentage of your future revenue. Some of the company’s original backers are YouTube sensation MrBeast, Twitch co-founder Justin Kan, and former NFL star Larry Fitzgerald.

Shutterstock

ShutterstockGoodLeap

Estimated Value: $12 billion

Headquartered in Roseville, California, GoodLeap caters to homeowners looking to take out loans in order to fund major green home improvement projects. They have partnered with various banks, including Goldman Sachs, to dish out more than $13 billion in loans almost 400,000 homeowners so far.

Originally, GoodLeap was only for homeowners who wanted to install solar panels, but lacked the up front money. Now they have dozens of different green categories you can get a loan for. Battery backup storage? Yep. New energy efficient windows? Sure. Special lawn turf that saves money on watering? You bet. If you want to make your home a bit more environmentally friendly, check out GoodLeap.

Source: GoodLeap

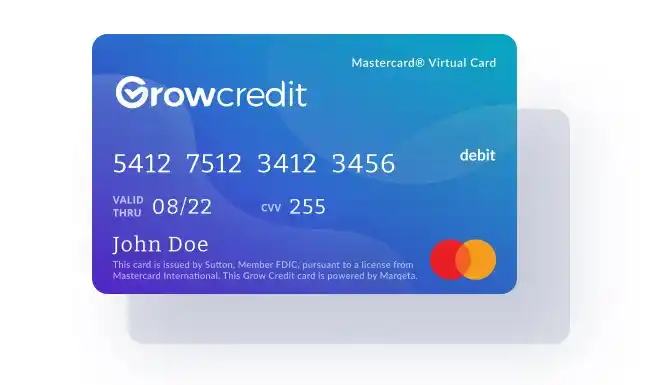

Source: GoodLeapGrow Credit

Estimated Value: $26 million

Grow Credit is, in a totally not surprising twist at all, a company designed to help customers grow their credit. Since your credit score factors into a lot of aspects of your life — some of which you might not expect — keeping a high credit score is always a good idea. Grow Credit does this by issuing “virtual” Mastercards to those with bad credit (or no credit history at all).

This virtual card charges no interest, but typically comes with a small monthly service charge. Grow Credit advises customers to add their monthly DisneyPlus or Apple Music charges to the card, giving it a small amount of activity. The service also links the virtual card to the user’s bank account, ensuring automatic on-time payments are made. The whole process can boost your credit score up to 50 points, according to the company’s website.

In the future, Grow says they plan to offer traditional credit cards that customers can “graduate” to after improving their creditworthiness.

Source: GrowCredit.com

Source: GrowCredit.comMelio and Mercury

Estimated Value: $4 billion (Melio) and $1.62 billion (Mercury)

These are actually two totally different companies. However, since their services overlap a lot, we are combining them together in this one section. In short, both Melio and Mercury are digital banking solutions aimed at small businesses and startups.

Let’s start with Melio. They target small Mom and Pop vendors who aren’t particularly financially savvy. No worries, though, because Melio makes it easy for those small businesses to pay bills, accept payment, and pay employees.

Mercury is a bit more full-featured, offering no-fee checking and savings account for startups and small businesses. They have all the things you might want — debit cards, wire transfers, and foreign currency exchange.

Both companies are great alternatives to the traditional banks, especially for small businesses trying to save money on banking fees.

Shutterstock

ShutterstockMorty

Estimated Value: $150 million

You know those sites that aggregate a bunch of car or home insurance quotes for you? Morty is that, but for mortgages. You fill in your details and Morty will find you potential mortgage offers from a range of lenders. It’s a great way to compare offers and do some competitive shopping around.

If you pick one of Morty’s offers, the terms lock-in as the software guides you through the rest of the process. Much like traditional mortgage brokers, Morty charges lenders a small fee once the loan closes. They’ve processed more than $1.2 billion loans to date and had $3 million in revenue in 2021 alone.

Source: Morty

Source: MortyPipe

Estimated Value: $2 billion

Pipe is a specialized trading platform that allows certain businesses to raise money. The platform sells recurring revenue streams (ie, monthly or annual fees and subscriptions) to institutional investors. Then those revenue steams are anonymized by Pipe, and sold based on risk profiles.

Sellers have already raised billions of dollars using Pipe since it debuted in 2020. The average return for investors is in the 4-to-8% range. In 2021, Pipe expanded outside of the U.S. and started offering services in the U.K.

Source: Pipe.com

Source: Pipe.com