Two of the most popular investment vehicles today are Exchange Traded Funds (ETFs) and bonds. While quite different from one another, ETFs and bonds are similar in that they can help individual investors grow their savings and prepare for retirement. In this article, we will look at both bonds and ETFs. We’ll explain how they work and how investors can benefit from buying into them. We’ll also explain some of the tax implications and risk factors that go along with purchasing these products. So what are index funds and bonds? Let’s get right into it.

Bonds

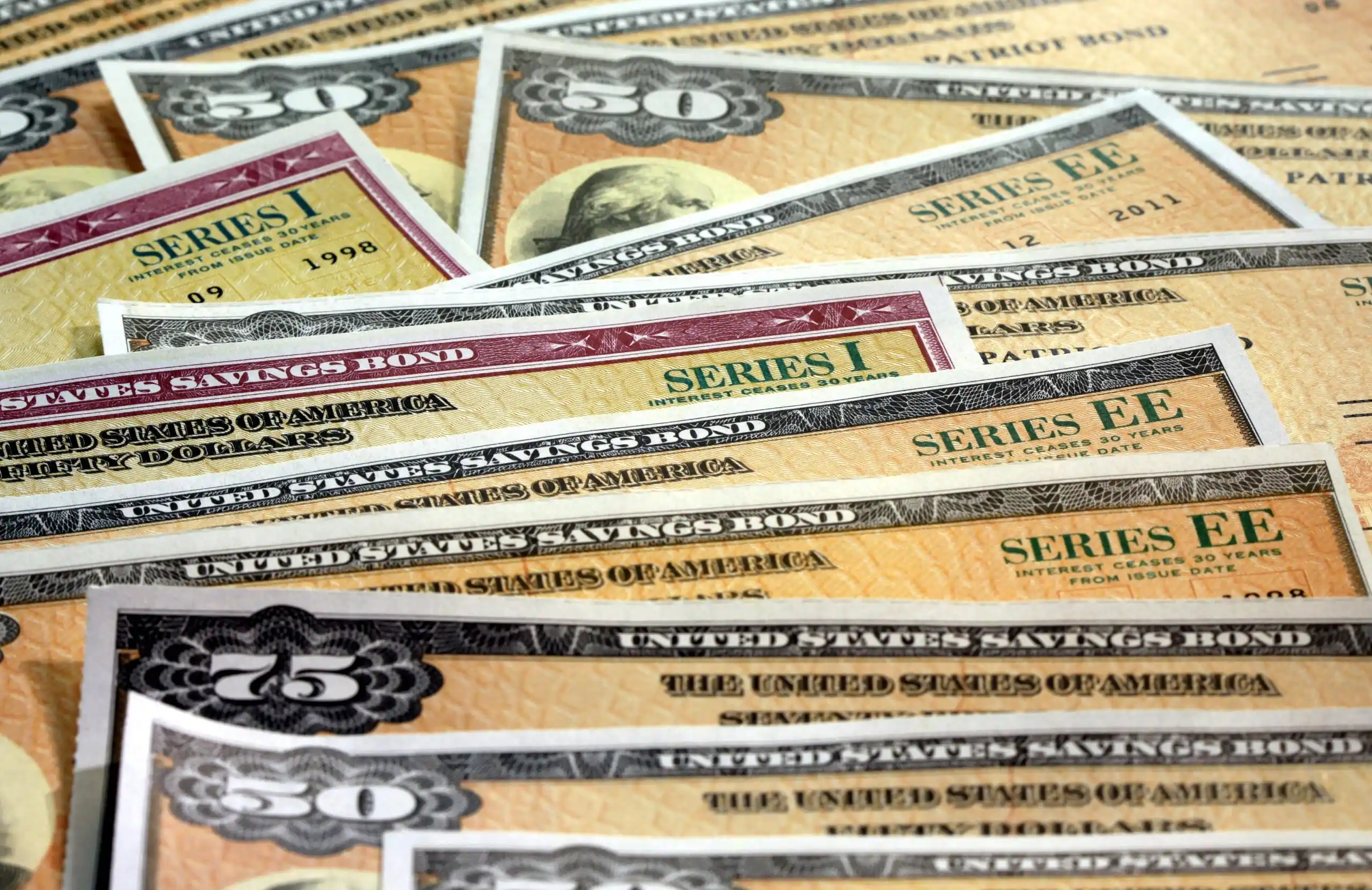

A bond is a fixed income asset. It represents a loan made by an investor to a borrower — typically a company or the government. A bond is sometimes likened to an I.O.U. between the lender and borrower. You are essentially lending the government (or corporation) money, which they promise to pay back (with interest) in a set about of time. Every bond includes the details of the loan and its repayment terms.

Bonds are used by companies and various levels of government (municipal, state, and federal) to finance projects and operations. Governments, for example, will issue bonds to fund road and highway construction. They are sometimes used in times of crisis too. For example, you may have heard the term “War Bonds” thrown around. In that case, the government sells bonds to fund military efforts with the promise of paying them back at a later date.

Bonds typically include an end date, when the principal of the loan is due to be paid to the bond owner. There is also usually terms for variable or fixed interest payments.

How Bonds Work

When companies or governments need to raise money to finance various projects, they issue bonds directly to investors. The borrower (company or government) issues a bond that includes the terms of the loan, interest payments that will be made, and the time at which the loan must be paid back.

Most bonds can be sold by the initial bondholder to other investors after they have been issued. In other words, a bond investor does not have to hold onto a bond all the way through to its maturity date. It’s also common for bonds to be repurchased by the issuer, if interest rates decline. Sometimes they will also be repurchased early if the issuer’s credit has improved and they can borrow money somewhere else at lower costs.

Types Of Bonds

There are several different types of bonds. The most popular types include corporate bonds (issued by companies), municipal bonds (issued by state and local municipalities), and government bonds (issued by the U.S. Treasury). They function mostly the same, though, regardless of who issued them in the first place.

The entire category of bonds issued by a government treasury is often collectively referred to as “treasuries.” Government bonds issued by national governments are typically referred to as “sovereign debt.”

Shutterstock

ShutterstockBenefits Of Bonds

The main benefit of a bond is that it provides investors with a set rate of return, payable on a predetermined date. In this respect, bonds are a much more stable investment than a stock or ETF. Those prices can fluctuate widely with the broader market. Bonds, on the other hand, are pretty a guaranteed return.

However, that predictable rate of return comes with some downsides. The profit (or interest rate) tends to be much lower than other investment types. An individual stock price could rise by 10% or more in a single trading day. A bond will never perform that well. On the other hand, it will never drop 20% in value either.

Due to their extremely predictable returns and scheduled payouts, bonds tend to appeal to retirees and older investors. Without an active income, they typically want to protect their money rather than aggressively trying to grow it with riskier investments. Bonds are often referred to as a “safe haven” investment. They allow you to safeguard your nest egg while still earning a modest rate of return.

Exchange Traded Funds

Exchange traded funds, or ETFs, are a much newer investment product than bonds. The first ETF was created in the mid-1970s by investor John Bogle, who founded and was the CEO of The Vanguard Group. Even today, the Vanguard ETF remains one of the largest issuers of ETFs in the world.

The first widely available ETF was introduced in 1993 to track the S&P 500 Index. Today there are more than 3,000 ETFs available to investors. In 2019, more money flowed into ETFs than mutual funds for the very first time. That signaled a shift in popularity towards ETFs among investors.

Passive Investment Vehicle

ETFs are one of the most passive investments you can own. They are not managed by an individual investor or a professional manager. An ETF simply replicates the stocks (and their weightings) in a particular index, such as the S&P 500.

As the stock index goes, so goes the ETF. If the stock index rises, the ETF rises. If the index declines in value, the ETF declines as well. While a mutual fund manager tries to beat the performance of a benchmark index such as the S&P 500, an ETF simply tries to match it.

Benefits of ETFs

The main benefits of ETFs are that they offer exposure to markets and diversification at a fraction of the cost of a more actively managed mutual fund. ETFs do not carry sales load fees. Investors will still probably pay a commission (if required) for trading an ETF. However, many ETFs trade for free through online brokerages.

When it comes to operational expenses, ETFs also tend to be cheaper than other investment vehicles. They usually offer lower management fees, since they are passive funds that don’t require stock analysis from professional fund managers. Transaction fees are also typically lower, as less trading is needed.

Trading On The Market

ETFs trade throughout the day on exchanges, just like an induvial stock. This active trading appeals to many investors who prefer real-time data for their investments. Investors also like the ability to buy or sell an ETF depending on what is happening with its price on a given day.

You don’t have to wait until the end of the trading day to execute a transaction with an ETF (as you would with a mutual fund). For this reason, many investors prefer ETFs. They can be traded like a stock and bought and sold at any time markets are open. And they tend to be much less volatile than an individual stock pick.

Return On Investment

Over the long-term, very few fund managers beat the stock market. For this reason, it’s often more advantageous to invest in an ETF than a mutual fund. Consider that the S&P 500 (comprised of the 500 largest U.S. companies) has provided an average annualized return of 9.96% since 1990.

By comparison, most mutual funds advertise annual returns of between 2.5% and 5%. When it comes to long-term performance and return on investment, it’s hard to beat an ETF. Given the unpredictable nature of stocks and the ups and downs of the market, even the most skilled fund manager will struggle to post better returns than an ETF.

Shutterstock

ShutterstockTax Implications

When it comes to taxes, ETFs are largely treated the same as stocks by the IRS. Unless an ETF is held in a tax sheltered or tax deferred account such as a 401(k), then you’ll be taxed on any capital gains and the dividends they receive. Make sure to budget accordingly.

Investments in a 401(k) can grow tax-free and do not incur taxes when trades are made. Keep in mind that ETFs do not usually payout capital distributions or dividends. That means they have a slight tax advantage over other investment vehicles that kick back regular income.

Risk Factor

Every investment comes with at least some element of risk. You don’t have to look back very far to see that a ton of average investors risked heavily betting on “meme stocks” like GameStop or AMC. Some of them made off like bandits. However, a lot of them bought the wrong stock at the wrong time and lost everything.

When it comes to risk, bonds and ETFs are some of the safest investments. Bonds are basically guaranteed by the government. If governments start defaulting on bonds, there are serious problems in the world. While corporate bonds are slightly riskier (the company could go bankrupt), they are generally considered fairly safe.

Likewise, an ETF is more than just picking a single stock, like Tesla or Amazon. It’s a fund of various securities. Even if a few of the piece of an ETC don’t perform well in a given time period, chances are that the other investments in the ETF will pick up the slack. Over a long enough time period, the ETF is almost guaranteed to increase in value. While stock market crashes can happen, they always bounce back eventually. So will the value of your ETF investment.

The Bottom Line

Bonds and ETFs are very different types of investments and each one has benefits. Which one is right for an individual investor will depend on their investment goals. People seeking growth should consider ETFs that track a specific stock exchange. While people who want a more stable and reliable investment that provides a predictable rate of return should consider buying bonds. For more information or advice on which investment vehicle is best for you, please consult an investment advisor.